B.C. home sales drop 35% as rising mortgage rates bite

'The housing correction has started'

Article content

Higher borrowing costs are continuing to weigh on British Columbia’s housing market as sales and home values slid in May over the previous month.

While the province’s average home price climbed more than nine per cent year-over-year to just over $1 million according to data from the British Columbia Real Estate Association, it was down six per cent from the $1.065 million recorded in April.

The association noted that sales slid as well, with 8,214 residential homes exchanging hands last month, down approximately 35 per cent from last May and eight per cent from April.

“Canadian mortgage rates continue to climb,” said BCREA chief economist Brendon Ogmundson in a press release accompanying the data. “The average five-year fixed mortgage rate reached 4.49 per cent in June. That is the highest mortgage rates have been since 2009.”

B.C. is not alone in seeing a slowing housing market. Other provinces have seen activity cool as well, led by major cities such as Toronto (which saw home prices drop for the third straight month in May), Montreal and Calgary.

Vancouver home sales slipped nearly 10 per cent from April to 2,918 units in May, also hitting a 32 per cent drop year-over-year in sales, according to data from the Real Estate Board of Greater Vancouver. The price of a home in B.C.’s most populous city remained relatively flat in May at $1.26 million.

The Bank of Canada’s hiking path has so far taken the overnight rate up to 1.5 per cent and signals that the Bank may have to get even tougher on inflation could put upward pressure on mortgage rates. Higher rates are keeping more would-be buyers on the sidelines.

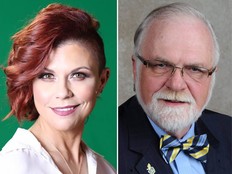

Steve Saretsky, Vancouver realtor and real estate specialist at Saretsky Group, told Financial Post’s Larysa Harapyn in a May 24 interview that the housing correction has already started.

“I don’t think it’s as pronounced as what I’m hearing from Ontario, but I definitely think we’re going through the start of a housing correction here,” Saretsky said, adding that the beginning of the correction is most concentrated in the suburbs. “(The suburbs are) the markets that I think went through the most froth where a lot of them were driven by pandemic people relocating, working from home. So, those markets are definitely seeing sales slow down. Inventory is slowly starting to build and we are seeing a modest decline in home prices there.”

Saretsky said a confluence of factors are behind the decline, including the correction of the pandemic’s housing bull market and higher mortgage rates.

• Email: shughes@postmedia.com | Twitter: StephHughes95

Postmedia is committed to maintaining a lively but civil forum for discussion. Please keep comments relevant and respectful. Comments may take up to an hour to appear on the site. You will receive an email if there is a reply to your comment, an update to a thread you follow or if a user you follow comments. Visit our Community Guidelines for more information.